Mayor Wendi Strom suspended normal City Council procedures to have an emergency discussion on January 13, 2025 regarding issues resulting from the new parkland dedication ordinance. Strom says this was time sensitive so it couldn’t wait until the next meeting and most of Council agreed with her. However, even with the suspension of city policies, Lakewood is still bound by the Colorado Open Meetings laws that require public notice for agenda items. Without that notice, there was no public comment regarding the discussion because no one knew it was happening. One issue Strom initially raised was concern that single-family homeowners are being required to dedicate part of their land to parks. However, other Councilors showed that the real issue was overall development. Strom says the city has not issued any permits since December 7, 2024, when the ordinance was approved. Council Member Nystrom, the only Councilor to sound positive about the new ordinance, pointed out that there may be inaccuracies on how the ordinance is being applied. Nystrom’s point of view was echoed by the author of the ordinance, Cathy Kentner.

Mayor Strom did not say how many people were adversely affected by the new ordinance, but this move is extraordinary. Even in other time-sensitive circumstances, such as when hundreds of Belmar Park residents were begging for emergency intervention, Strom did not suspend the rules. In fact, with her inauguration, she has moved public comment to the end of the meeting in a move that guarantees most people do not stay for comment. The parkland ordinance itself was time sensitive due to the ballot initiative deadlines. Council chose not to address the issue at all.

Strom asked for a vote to direct staff to present some amendments to the ordinance at the January 27 meeting. She also later agreed with Councilor Roger Low’s statement that “it would be incumbent on members of council to proactively draft those amendments and work with the city attorney’s office, presumably to draft those amendments and circulate them [we] will be authoring the amendments and staff merely writing them up.”

It is evident that many processes will still be decided over the next month. No data was presented to demonstrate the problem, but Mayor Strom says that will be coming as staff present real life stories of the harm the ordinance is doing to residents and staff. No one mentioned the residents who were positively affected by the ordinance except for Councilor Nystrom.

Accusations of Bait N Switch

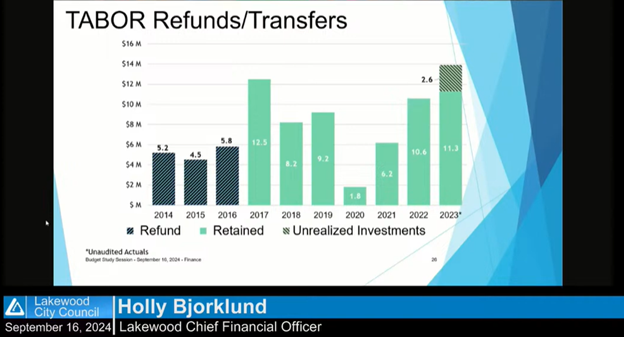

Strom says she does not believe residents knew what they were signing or the unintended consequences of the original petition. This narrative was espoused by several Councilors at previous meetings, including multiple times by Council Member Roger Low. It’s an ironic stance to take coming from the council who approved official ballot language to de-TABOR the city without ever mentioning TABOR.

Council Member and Mayor Pro Tem Shaharezaei went so far as to accuse the resident petition gatherers of pulling a bait and switch. She says they touted the initiative as a way to get more parkland but really it was about reducing density. She says these unintended consequences are something that needs a response.

Shahrezaei did not acknowledge that the parkland dedication initiative was a result of unintended consequences of City Council not being accountable for adequate oversight of the existing ordinance. That issue has been ongoing for over a decade. But Councilor Low ran through some math to acknowledge that resident density and parkland should have some sort of equilibrium.

Parks Versus Development

The ordinance is not about development per se. It is about the fact that more people need more parks in order to sustain the equilibrium Councilor Low spoke of. For decades people have moved to Lakewood for the plentiful parks. So much so that Lakewood Council recently pushed a bill to de-TABOR, partly to fund park expansion.

Many Councilors returned to the original argument from months ago that there was no way to mandate reasonable parkland dedication and still allow development. Those Councilors just want the development. Urban versus suburban development.

Councilor Mayott-Guerrero said that she hears the frustration of residents but there are several projects in her ward that are underway and are affected by this ordinance. She says that she has not heard any objection to developing several large lots in her ward. “Whatever your motivation and your impetus is, I believe that the way that this was written is going to result in a level of cost to the people of Lakewood and to the community that is really irresponsible for us to allow to continue.”

Council Member Cruz pointed out that this is impacting affordable housing developers. Affordable housing developers include Metro West Housing (MWH). Cruz did not discuss the MWH attempt to put 44 units on 1.6 acres, without including enough parking or a wide street, let alone neighborhood parkland for these new residents.

Councilor Sinks clarified that there was not a ordinance rewrite. Councilor LaBure agreed, stating that this would not be a rewrite, but rather tweaking some words.

Willful Misinterpretation

Councilor Nystrom says there are inconsistencies and, in her opinion, inaccuracies around the way the new ordinance has been applied. She also pointed out that there are many positive emails from residents, it’s not all negative as the other Councilors state.

Nystrom’s comments hint that the ordinance interpretation may be being used as a political football. She is the only Councilor to bring up a contrarian view and sound supportive of the resident-sponsored initiative.

Normal City Council procedure requires Councilors to submit a Request for Council Action to start a discussion. In other governments, elected officials can introduce legislation and call for a vote. In Lakewood, instead of Council Members authoring legislation, they must gain agreement from a majority of Members to hold a study session to generate ideas. Alternatively, they can assign staff or a committee to find solutions.

No Time to Think It Through

City Attorney McKinney-Brown says this move is “unusual but nothing illegal.” City Council must work by passing ordinances. She continues, “If the City Council believes they have plenty of time to workshop this and think their way through it, then you can start from a, a less intensive jumping off place.”

Her statement seems to suggest that Council may be acting off gut reactions and hasty conclusions. However, Council Member Low “signaled” that a third reading may be used to add additional time due to the amount of public interest in the topic and Councilor Rein agreed.

Council voted unanimously for the motion to have a first reading January 27.